As an asset or CSR manager, you need to preserve the value of your real estate investments. Therefore, it is now more important than ever to reduce CO2 emissions and achieve the German Federal Government’s proclaimed goal of a climate-neutral building inventory by 2045. In addition, the mandatory ESG sustainability reporting and the Taxonomy Regulation require buildings to be assessed for their environmental sustainability.

ESG success will be measured in Euros in the future

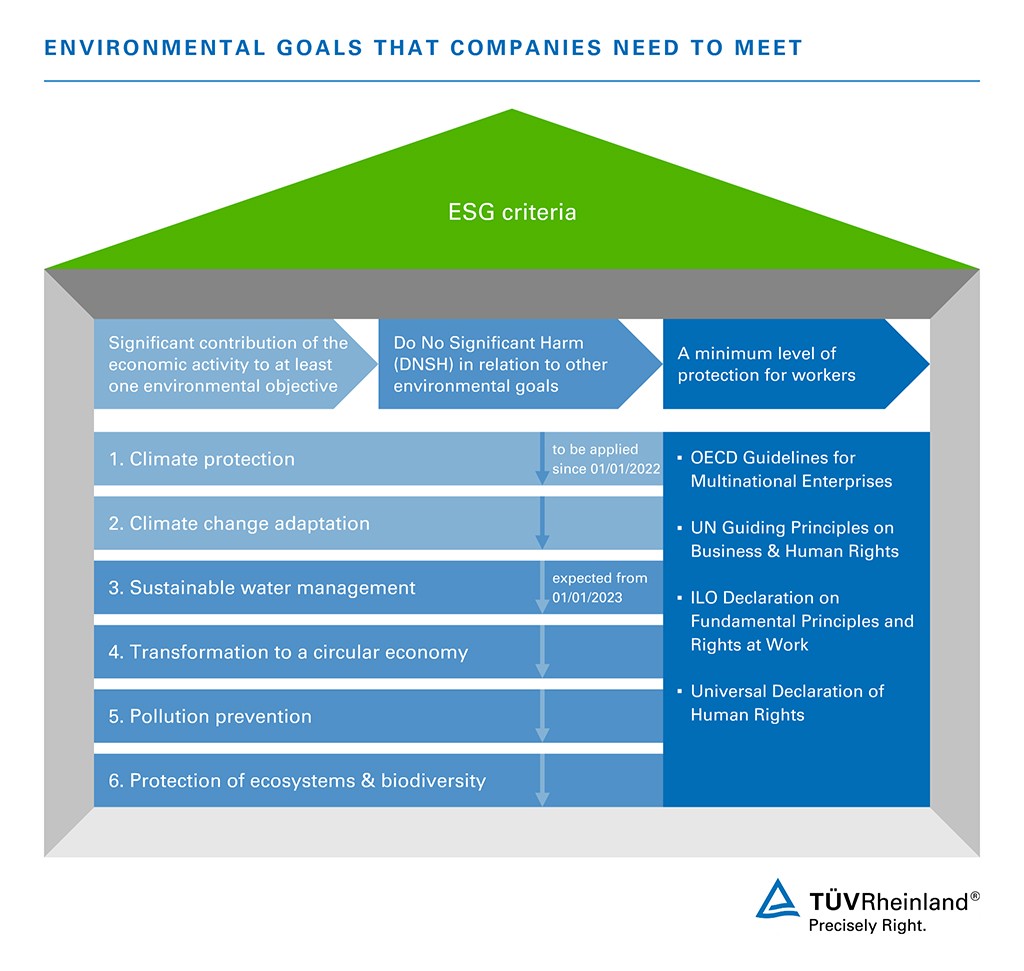

As part of regulating Environmental, Social and corporate Governance (ESG) criteria, the Sustainable Finance Disclosure Regulation (SFDR) came into force on March 20, 2021. Ever since, the real estate industry too has been required to report ESG sustainability criteria.

And because the real estate sector is one of the largest CO2 emitters in the EU, accounting for around 40 percent of the total final energy consumption, this issue is at the top of the agenda. First, to protect the climate and the environment, and second, to avoid possible sanctions, save energy costs, remain attractive for investors and avoid a loss of value or even a total loss due to stranded assets.

Taxonomy as a value driver for climate-neutral buildings

The Taxonomy Regulation plays a key role in this process. In the first step, it addresses the “E” in ESG, specifically climate protection. Applicable since January 1, 2022, the Sustainable Finance Taxonomy creates the foundation for classifying the sustainability of financial products and investments. It also aims to steer financial flows into sustainable and climate-neutral investments and to prevent greenwashing.

For the real estate industry this means that it must apply the required criteria in new constructions, renovations, acquisition and ownership of buildings and report on them. This creates new challenges, which our taxonomy check can help master.

| Challenges | Solutions |

|---|---|

|

|

|

|

|

|

|

|

|

|

|

|

Who is required to provide sustainability reporting?

Due to the disclosure and reporting obligations of the new EU regulations, operators and owners of buildings are required to demonstrate a significant contribution to at least one of the environmental goals or to prove taxonomy compliance of their properties. Banks and other financial market players can use the Sustainable Finance Taxonomy to assess how sustainable their financial flows are.

In general: Those who do not identify investments as sustainable can apply the taxonomy voluntarily. However, there is likely to be a significant competitive disadvantage for those not adapting to the new standards and not disclosing the sustainability level of their properties.

Important to know: In the first step, the taxonomy focuses on the proclaimed climate targets. These must make a substantial contribution to at least one of the environmental goals and must not harm any of the other goals (Do No Significant Harm, DNSH rule). In the long run, additional activities from the social and corporate governance areas will be included.

Achieve ESG goals, gain greater sustainability

The real estate industry faces major challenges. One critical obstacle is the implementation of the mandatory ESG criteria and taxonomy requirements. Another relates to data management to achieve the necessary transparency with regard to sustainability. Only those who position themselves early on and find the answers to important questions will benefit in the long run.

Our consulting service for a sustainable real estate industry

- Taxonomy check: Support with taking inventory and reviewing the documentation to meet the taxonomy requirements.

- Conformity assessment: Support with verification and with the reporting of measures to meet the taxonomy requirements

- CSR consulting, sustainability strategy

- Carbon services (carbon footprinting (CCF, PCF), life cycle assessment)

- Support for climate protection projects

- Climate protection audits to develop measures and roadmaps to achieve the goal of climate neutrality

- Climate protection management, including monitoring of optimization measures to achieve climate neutrality

- Verification of greenhouse gas emissions and certification of climate neutrality

- Energy efficiency consulting and subsidy consulting / Energy audits according to EDL-G / Energy management systems consulting ISO 50001